All credit and debit cards are now being made with “a computer that is 1/4 the size of a postage stamp” this technology we know as a chip card. Chip cards are extremely beneficial to the security of cardholder information. When chip cards are inserted, they create a unique transaction ID (also known as Tokenization) every time the card is used; when using the traditional magnetic strip card, you have the same transaction ID every time making you vulnerable to hackers.

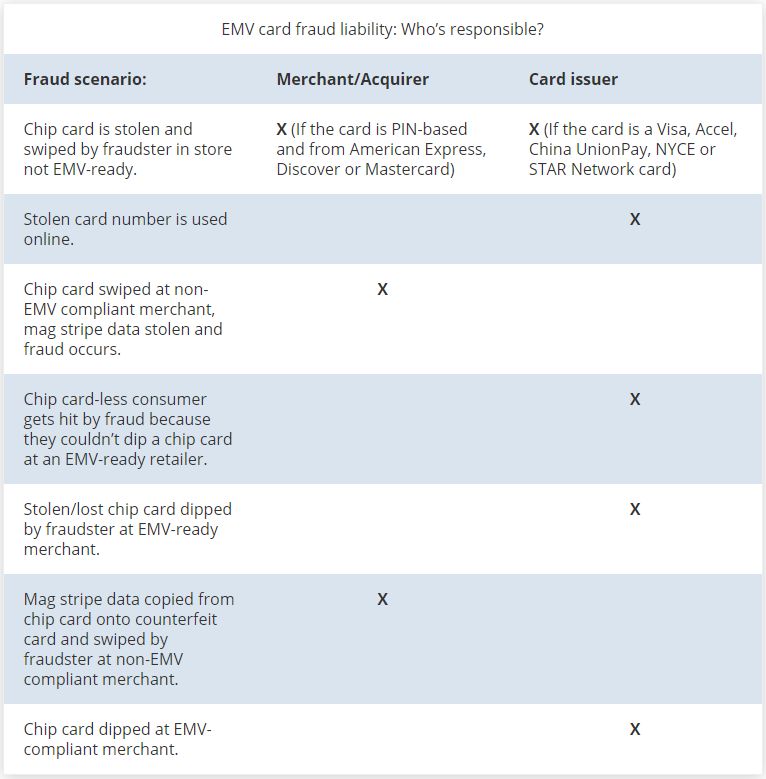

For companies processing Credit Cards transactions, the liability shifted after Oct. 1st 2015. The graphic below outlines who is responsible for fraudulent transactions based upon how the fraud occurs and the level of protection and use of Chip technology at the company accepting the Credit Card for processing.

Discover and share the latest cybersecurity trends, tips and best practices – alongside new threats to watch out for.

And yes, Google's Gemini AI had no idea it was working for the bad guys. Malware has always followed a script....

Read more

Ransomware groups are not breaking in organizations the same way they did five years ago. The entry methods have...

Read more

If a Chrome extension promises to remove security pop-ups and generate MFA codes, that should make you...

Read moreGet sharper eyes on human risks, with the positive approach that beats traditional phish testing.