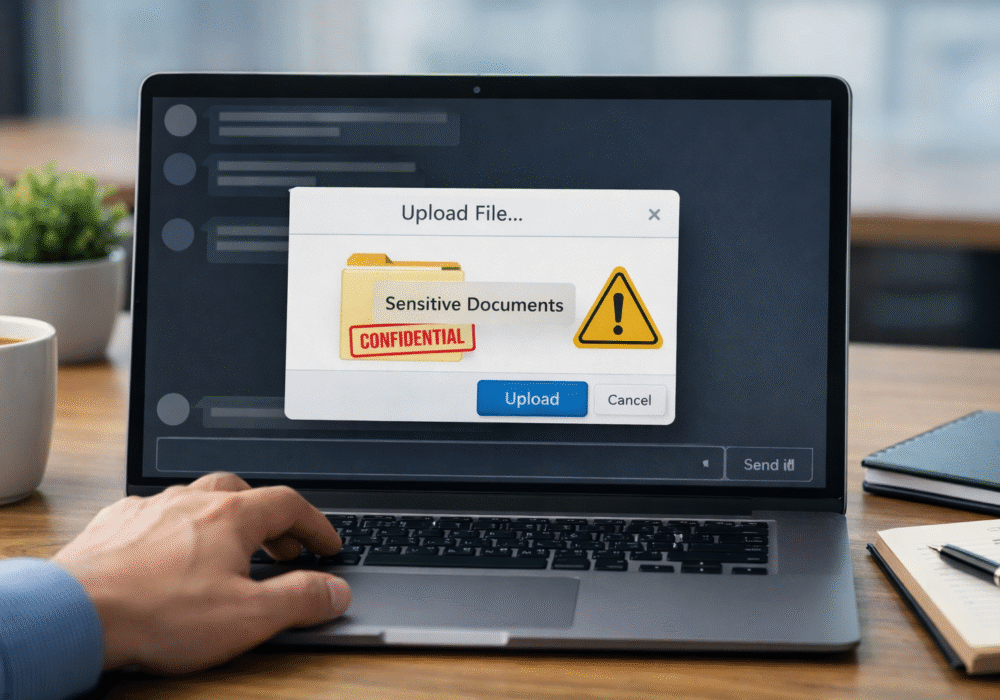

Cyber Insurance is a form of insurance for businesses and individuals against Internet-based threats. Many high profile data breaches have prompted insurance companies to offer cyber insurance policies to protect clients from the devastating effects of data breaches. Cyber Insurance policies typically cover losses that are related to hacking, malware, theft, extortion, or lawsuits that come from security breaches. Cyber Insurance is a great tool to have, although it does take time to implement as the insurance carriers typically require a lengthy questionnaire to be completed outlining your protective measures and risk factors.

Source: Techopedia, Fundera

Additional Reading: Questions To Ask When Buying Cyber Insurance

Related Terms: Hackers, Malware, Phishing

SMBs are such a prime target for hackers that it is a good idea to look at Cyber Insurance for your company. SMBs make up approximately half of the targeted attacks in the cyber world. SMBs need to ensure they are doing whatever they can to secure themselves, as hackers know SMBs tend to lack proper security measures. Working with an insurance company and purchasing a cyber insurance policy to help when you most need it, immediately following a breach, is a great idea for businesses nowadays. Not only should you employ cyber insurance, but your company should be training your users on the cybersecurity basics and governing them with policies as well. Work with CyberHoot to get your policy governance up-to-date and train your users to spot and avoid the threats they face on the Internet.

Discover and share the latest cybersecurity trends, tips and best practices – alongside new threats to watch out for.

Cyberattacks usually start with phishing emails or weak passwords. This one did not. Security researchers...

Read more

Not surprising when Trouble Ensues Last summer, the interim head of a major U.S. cybersecurity agency uploaded...

Read more

And How to Fix Them Let me make an educated guess. You moved to Google Workspace because it was supposed to...

Read moreGet sharper eyes on human risks, with the positive approach that beats traditional phish testing.